Economic inequality is at record breaking levels in the U.S. The American oligarchy is powerfully wielding its economic and political power. Public policies can stop and reverse the growing economic inequality. See examples below. If Democrats or others want to garner support and votes, they should support policies to reduce economic inequality and create a secure economic future for working Americans.

(Note: If you find a post too long to read, please just skim the bolded portions. Thanks for reading my blog!)

(Note: Please follow me and get notices of my blog posts on Bluesky at: @jalippitt.bsky.social. Thanks!)

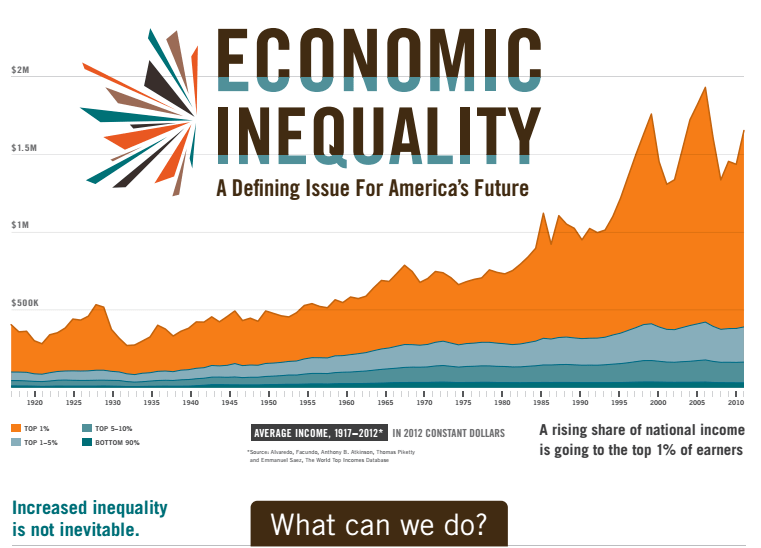

Economic inequality is at record breaking levels in the U.S. America now has 916 billionaires whose combined wealth is $8 trillion (yes, trillion). Their wealth has increased by over $1 trillion in the first nine months of 2025. Since the passage of the Republican tax cut bill in 2017, it’s increased from $3 trillion to $8 trillion. For comparison, the least wealthy 167 million Americans (half the population) have combined wealth of just $3.6 trillion. In other words, the combined wealth of 167 million Americans is less than half the wealth of the 916 billionaires. The rise in billionaires’ wealth reflects the transfer of profits of economic activity away from workers and to owners and investors.

A big part of this is the increase in the value of the stocks of companies these billionaires own and in which they invest. Provisions in the 2017 Republican tax cut bill (that were continued by the GOP’s Big Ugly Bill in July 2025) give huge tax breaks to corporations. For example. Alphabet (Google’s parent) gets $17.9 billion, Amazon gets $15.7 billion, and Microsoft gets $12.5 billion.

With their great wealth, these billionaire oligarchs have great political power, especially given the laws and court decisions allowing unlimited spending in political campaigns. This basically allows them to buy our elected officials, as Elon Musk bought Trump with the over $250 billion he spent on Trump’s campaign. “Highly concentrated wealth leads naturally to concentrated political power.” [1] As Supreme Court Justice Louis Brandeis wrote almost 100 years ago, “We may have democracy, or we may have wealth concentrated in the hands of a few, but we can’t have both.”

The oligarchs have been wielding their political power very effectively for the last 45 years, and especially in the last ten years. They’ve succeeded in getting policies enacted that enrich themselves and leave American workers not just short changed, but shafted. Public policies to provide economic security for working Americans will never happen if the oligarchs retain their political and economic power. (This previous post presented policies to increase workers’ incomes and this post highlighted policies to reduce the cost of living for them.)

Therefore, the policies that allowed economic inequality to grow over the last 45 years, and to explode in the last 25 years, need to be changed. A group called Patriotic Millionaires has proposed “The Money Agenda,” a set of policies that would reduce economic inequality and “permanently stabilize the economic lives of working people, stimulate wide-spread economic growth, and ensure prosperity and stability for America’s next 250 years.”

The Money Agenda includes four pieces of legislation. Here’s a quick overview of them:

- The Equal Tax Act

- Increase tax rates on income from wealth (e.g., capital gains) so they are the same as the tax rates on income from work

- Close the loophole that allows the wealthy to give away appreciated assets and dodge anyone having to pay tax on their increase in value (i.e., the stepped-up basis loophole)

- The Anti-Oligarch Act

- Phase 1: Stop the growth of economic inequality by putting a reasonable tax on the true income of the wealthy (e.g., including increases in wealth) and on the intergenerational transfers of wealth

- Phase 2: Reduce economic inequality by implementing a wealth tax on the ultra-rich

- The “Cost of Living” Tax Cut Act

- Establish a Cost of Living Exemption of about $45,000 in order to eliminate income tax on income up to a reasonable cost of living for a single adult without children

- Pay for the lost revenue by putting a surtax on incomes over $1 million

- The “Cost of Living” Wage Act

- Raise the minimum wage to a living wage for a single adult with no children, or about $21 per hour (roughly $45,000 per year for full-time work) and index it to inflation

- Protect workers from loss of income due to automation or AI

The Economic Policy Institute recently issued a report titled “Raising taxes on the ultrarich: A necessary first step to restore faith in American democracy and the public sector.” It states that if “policymakers are unwilling to raise taxes on income derived from wealth, the tax system can never be made as fair as it needs to be.” Its recommendations echo the provisions of The Equal Tax Act and The Anti-Oligarch Act above.

It also proposes:

- Replacing the estate tax with a progressive income tax on those receiving an inheritance.

- Raising the top marginal income tax rate back to its pre-2017 level (i.e., from 37% to 39.6%). This would generate revenue of over $30 billion a year. (Note: In 1980, the top rate was 70% and it was over 90% in the 1950s.)

- Returning the corporate tax rate to 35% (where it was before the 2017 Republican Tax Cut Act reduced it to 21%). This would generate over $250 billion a year in revenue.

- Closing tax loopholes that the ultrarich and corporations use to evade taxes.

- Strengthening the IRS’s capability to enforce tax laws. The IRS estimates that $600 billion in taxes that are owed are not paid each year. However, in recent decades it has lacked the resources to enforce the laws and collect those taxes because Republicans have underfunded it.

If Democrats, or another party such as the Working Families Party, want to garner support and votes, they should support these policies to reduce economic inequality and the economic and political power of the American oligarchy. These and related policies would also provide economic security for working Americans. Democrats should be unequivocal in embracing economic populism and stop cozying up to the oligarchy and their PACs for campaign contributions. [2] To consistently win elections, Democrats need to loudly and unequivocally promote a vision of a more economically secure future for working Americans.

[1] Bivens, J., 11/17/25, “Raising taxes on the ultrarich,” page 5, Economic Policy Institute (https://www.epi.org/publication/raising-taxes-on-the-ultrarich-a-necessary-first-step-to-restore-faith-in-american-democracy-and-the-public-sector/)

[2] Reich, R., 11/3/25, “What the Democrats must do. Now!” (https://robertreich.substack.com/p/what-the-democrats-must-do-now) /