Trump is the culmination of decades of work by wealthy individuals and corporate CEOs (i.e., America’s oligarchs) undermining democracy and skewing government policies. This has led to dramatic income and wealth inequality. Many Americans have lost their economic security, as well as their faith in government and democracy.

SPECIAL NOTE: We need millions of Americans at the No Kings protests on October 18 in defense of democracy. Please support this however you can. You can find an event near you at: https://www.mobilize.us/nokings/map/?tag_ids=27849.

(Note: If you find a post too long to read, please just skim the bolded portions. Thanks for reading my blog!)

(Note: Please follow me and get notices of my blog posts on Bluesky at: @jalippitt.bsky.social. Thanks!)

I’ve been surprised at how little spine corporate Chief Executive Officers (CEOs) (supposed “leaders”) have shown in the face of Trump’s behavior and attacks. They know that unpredictability and chaos in government, as well as uncertainty, polarization, and unrest in society (in America and globally), are bad for the economy and for their businesses, at least in the long run. They know that an autocrat’s lack of respect for the rule of law, for property rights, and for freedom of speech are bad for business.

However, the CEOs of large corporations (aka corporate oligarchs) tend to be pragmatic and short-sighted. They value having political power and influence to the point that they seem to care little about politicians’ ethics or actions on issues that don’t conflict with their corporate interests. They know their large corporations are dependent on the government for many things, e.g., approvals of mergers, government contracts, tax breaks and subsidies, and licenses to operate. And they know their corporations are affected by many other things government does, e.g., writing and enforcing regulations, tax laws, and export and import policies (e.g., tariffs). [1]

President Trump has been leveraging (generally illegally) these many interrelationships between the government and corporations to pressure CEOs to do what he wants them to do, to support his policies, and to support him personally (sometimes financially). CEOs know Trump is arbitrary, unpredictable, and vindictive. They know that if he is irritated by a company or its CEO that he will use the powers of the government in a punitive fashion against them. Therefore, they capitulate.

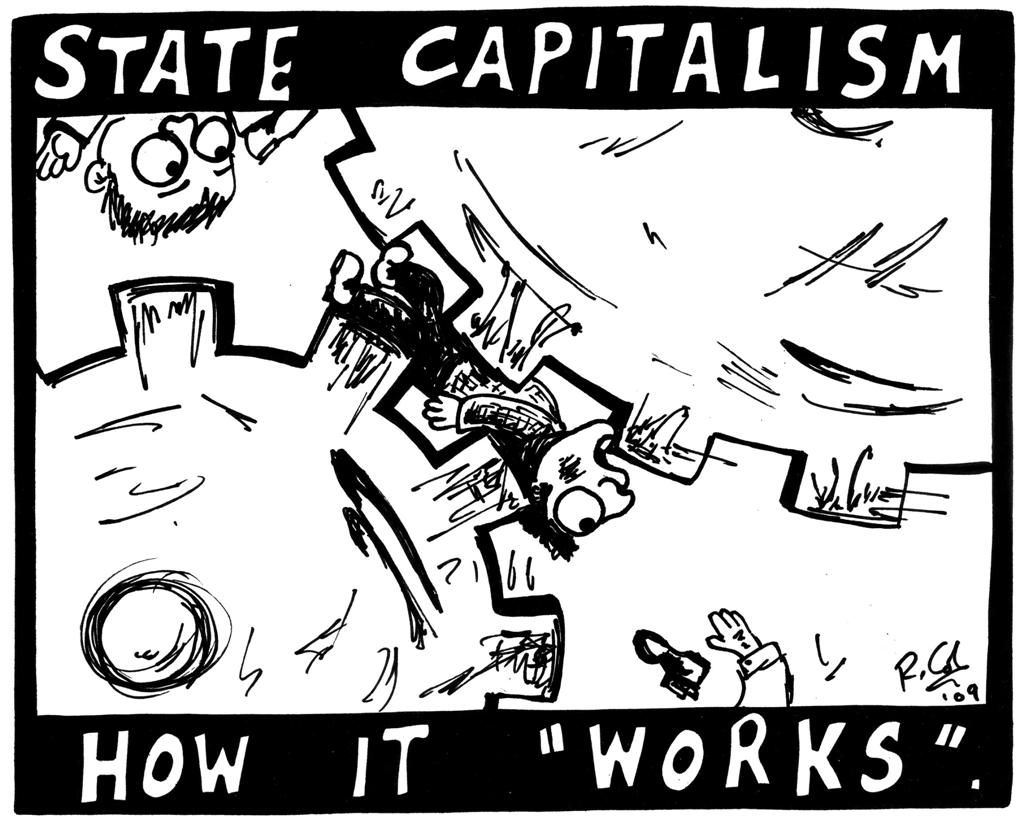

However, Trump and his anti-democratic, autocratic, and fascist behavior and administration are the culmination of decades of work by wealthy individuals and corporate CEOs (i.e., America’s oligarchs). They have been undermining democracy and skewing government policies and our economy in their favor for at least 45 years. They have quadrupled their political spending (after adjusting for inflation) over the last 40 years. [2] In the 2023-2024 federal election cycle, $5.3 billion was spent on the presidential race and $9.5 billion was spent on congressional races. The overwhelming majority of this money came from American oligarchs. One hundred billionaires alone spent $2.6 billion. The seven highest spending individuals spent $930 million, all for Republicans, with Elon Musk leading the way with $291 million in spending, almost exclusively for the Trump campaign.

In addition to spending on election campaigns, corporations are also spending over $4 billion a year lobbying the federal government. [3] Furthermore, they engage in an extensive “revolving door” cycle of personnel (tens of thousands of them) who move between government regulatory agencies and positions in corporations the agencies regulate. [4]

All of this is in the interest of skewing government policy to favor American oligarchs, i.e., wealthy individuals and their large corporations. They have been very successful; their return on investment has been extraordinary.

My next post will provide specific examples of their successes, along with the effects and implications of them.

In the meantime, please make plans to stand up for democracy and against the oligarchs. I hope you can participate in and/or support the No Kings protests on October 18 – and the many, many other smaller protests that are occurring daily. Thank you for all you are doing! Please keep up this great and important defense of democracy!

Find a No Kings October 18th event near you here.

[1] Edelman, L., 9/23/25, “Why corporate leaders are appeasing Trump,” The Boston Globe

[2] Reich, R., 9/26/25, “Why are we so polarized? Why is democracy in such peril?” Blog post (https://robertreich.substack.com/p/why-are-we-so-polarized)

[3] Open Secrets, retrieved from the Internet 9/29/25, “Lobbying data summary,” (https://www.opensecrets.org/federal-lobbying/)

[4] Open Secrets, retrieved from the Internet 9/29/25, “Revolving door overview,” (https://www.opensecrets.org/revolving-door/)