The revulsion at the violence, cruelty, terrorizing, lawlessness, and killings by ICE and CBP continues to grow. I urge you to contact your U.S. Senators and Representative NOW and ask them to block funding for ICE, CBP, and DHS until a full house cleaning and a total revamping of their operation make them compliant with the rule of law and the best practices of policing. Also, put March 28 on your calendar for the next No Kings protest.

(Note: If you find a post too long to read, please just skim the bolded portions. Thanks for reading my blog!)

(Note: Please follow me and get notices of my blog posts on Bluesky at: @jalippitt.bsky.social. Thanks!)

THANK YOU to the people of Minneapolis and Minnesota for showing us all how to stand up to ICE with dignity, strength, non-violent protest, and community support for vulnerable people. The broad, nationwide revulsion at violence, cruelty, terrorizing, lawlessness, and killings by Immigration and Customs Enforcement (ICE), Customs and Border Protection (CBP), and their parent agency, the Department of Homeland Security (DHS) continues to grow. They, Trump, and his administration continue to lie about what they’ve done, are doing, and who they target and detain, as well as to smear and defame their victims.

Everyone, and especially every Republican in Congress and elsewhere, who is not standing up, condemning, and calling for an end to this domestic terrorism in service to an authoritarian president is complicit in this heinous behavior.

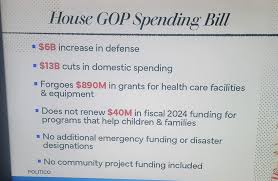

My previous post provided an overview of ICE and CBP actions and noted that the cruelty is the point and that the lawlessness is a feature not a bug. It encouraged you to contact your U.S. Senators to ask them to block the budget for ICE until changes were made. The Senate has now passed most of the federal government’s budget for the rest of the year (through Sept. 30), but funded DHS (including ICE and CBP) for only two weeks to allow negotiations over funding amounts and stipulations for full-year funding.

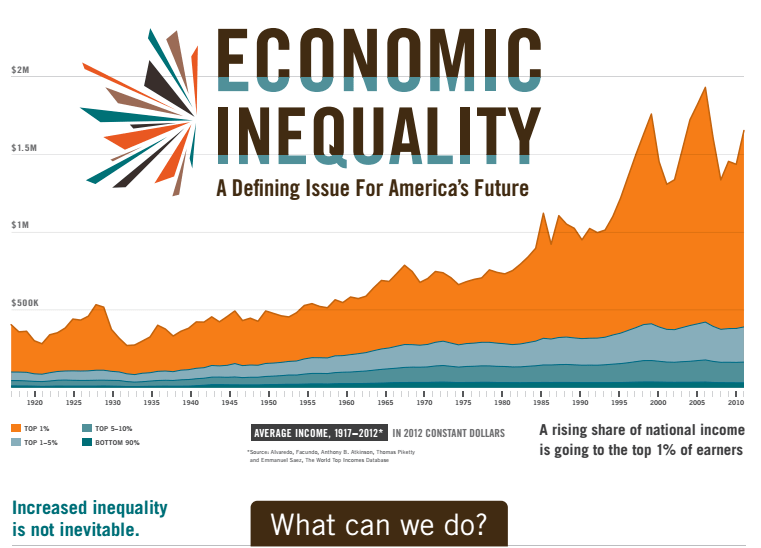

I strongly urge you to contact your U.S. Senators and Representative NOW and to ask them to block the budget for ICE and CBP until major reforms are made. You can call them or email them through their congressional websites. A bill will have to be passed by both the Senate and the House to fund DHS, including ICE and CBP. The level of funding for ICE and CBP should also be dramatically cut from the combined $36 billion a year currently budgeted. [1]

(Contact information for your US Representative is at http://www.house.gov/representatives/find/ and for your US Senators is at http://www.senate.gov/general/contact_information/senators_cfm.cfm.)

ICE and CBP should meet the standards of any other police force in the country at a minimum. Additional requirements are also appropriate due to their past behavior and unique role. Here’s a list of some, but not all, of the things Congress should demand before funding ICE and CBP. It’s a long list, as the problems run deep, so pick a few items that resonate with you to mention when you contact your Senators and Representative. Also, feel free to put them in your own words. Let your elected officials know how upset or angry you are. Furthermore, tell them that strong enforcement mechanisms should be included because the track record of ICE, CBP, DHS, and the Trump administration has been to ignore Congress’s funding and policy directives.

Here are options for your message to your elected officials. Do NOT fund ICE or CBP until:

- Thorough, credible investigations by local law enforcement of the killings of Renee Good and Alex Pretti are underway with cooperation from all federal officials and agents.

- All deaths and violence at the hands of ICE and CBP are and will be credibly investigated. In the last seven months, at least eight people have died and others have been shot in ICE and CBP actions. Furthermore, at least 35 people have died in ICE detention. These are minimum numbers as the Trump administration is obviously working to hide the extent of the violence and deaths. [2]

- ICE and CBP agents are prohibited from wearing masks and carrying guns. (If they need armed law enforcement support, they should contact local or state police.)

- ICE and CBP agents are required to wear personal identification. (As police officers do.)

- ICE and CBP agents are required to have warrants from judges to arrest someone or search their home or vehicle. (As local and state police officers do.)

- ICE and CBP agents are required to wear body cameras at all times and to activate them whenever they are engaged in enforcement activities.

- ICE and CBP agents are required to pass background checks and have training equivalent to what a local or state police officer receives. Current agents who don’t meet these criteria are fired but allowed to reapply under these standards.

- ICE and CBP commit to the same standards of behavior, operation, discipline, and investigation of officers as state and local police. Among other things, this would stop racial / ethnic profiling and performance quotas.

- It’s made clear that ICE and CBP agents do NOT have immunity from prosecution under state laws.

- Arrests at sensitive locations are banned, such as courthouses, hospitals, schools, daycare providers, shelters, and places of worship.

- Detention and deportation of legal residents is ended.

- Detention and deportation of undocumented residents is ended unless they have a serious criminal conviction. This comports with what Trump and his administration say they are doing.

- Detention of caregivers of children and of children is ended. In these situations, federal agents should contact and coordinate with state child welfare agencies.

- ICE and CBP agents are only allowed to operate away from the border when they have a judicial warrant for the arrest of a specific individual.

- Targeting cities and states for political reasons is banned.

- Strong oversight and humane conditions at detention facilities are required.

- Requests or agreements that state or local police perform ICE or CBP duties are banned.

- The leaders of ICE and CBP, starting from the top with DHS Secretary Noem, should resign or be impeached, and should be disciplined or prosecuted for their illegal actions. For example, for the detentions of U.S. citizens and those with no criminal record; for illegal deportations, violence, and forced entries into people’s homes; and for violations of judges’ orders.

As this list makes clear, the problems at ICE, CBP, and DHS are very serious and deep-seated. Please encourage your Senators and Representative to demand a full house cleaning and a total revamping of ICE and CBP to make them compliant with the rule of law and the best practices of policing.

A major, nationwide protest of ICE, CBP, and the Trump administration is being planned for No Kings Day 3 on Sat., March 28. A general strike may be organized in conjunction with this day of protest. Please put March 28 on your calendar now and plan to participate in and support the protest however you can.

[1] Hubbell, R., 1/29/26, “The people have put their lives on the line to resist ICE; Senate Democrats must now do their part to reform ICE from the ground up,” Today’s Edition Newsletter (https://roberthubbell.substack.com/p/the-people-have-put-their-lives-on)

[2] Curry Wimbish, W., 1/29/26, “A running count of how many people ICE has killed and injured,” The American Prospect (https://prospect.org/2026/01/29/ice-trump-killed-injured-list-dhs-cbp-border-patrol-renee-good-alex-pretti/)