Our democracy’s challenges are serious and longstanding. I presented an overview of the challenges, some history, and then focused on the selection of the president via the undemocratic Electoral College, including how to fix it, in a previous post. This post focuses on Congress. The Senate is a long way from the one person, one vote representation on which democracy is typically built. The extreme gerrymandering of some U.S. House districts (and of some state legislative seats) means that democracy is subverted there too. Finally, the Supreme Court has allowed elections to be held with gerrymandered districts.

(Note: If you find my posts too long to read on occasion, please just skim the bolded portions. Thanks for reading my blog! Special Note: The new, more user-friendly website for my blog is here.)

Like the process of selecting the president via the Electoral College, the process for electing members of Congress is also flawed and undemocratic. The Senate, while established in the Constitution at two seats per state, is blatantly unconstitutional under the “one person, one vote” standard established by the Supreme Court in the 1960s based on the Constitution’s Equal Protection Clause. Although Senators are elected now rather than appointed by state legislatures (due to the 17th amendment to the Constitution in 1913), Senate representation is clearly undemocratic based on a state-to-state comparison. [1] For example, a California Senator represents the state’s 39 million people, over 67 times the 581,000 people a Wyoming Senator represents.

All Representatives in the U.S. House do represent similar numbers of people, but in some states the districts are so gerrymandered that they do not reflect the population of the state politically or racially. In part because of partisan gerrymandering, very few House elections are competitive. In 2022, only 30 out of the 435 House seats had a margin of victory of less than four-percentage points (i.e., 52% to 48% or closer). [2]

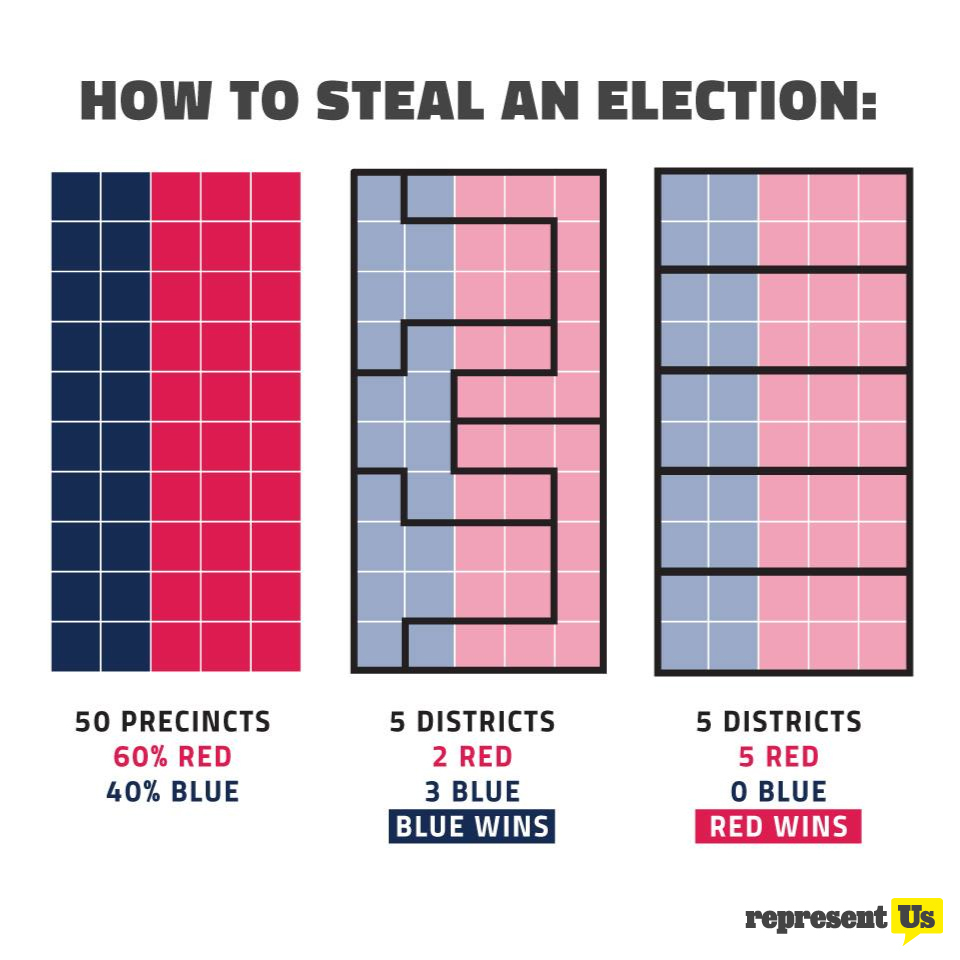

Gerrymandering, which is the manipulation of the boundaries of an electoral district to predetermine the outcome based on party, race, incumbency, or other factors, has been happening for a long time. Gerrymandering has become more blatant and effective in the 21st century because computers and mapping software now allow more sophisticated mapping using more detailed data.

In the redrawing of U.S. House districts after the 2010 Census, independent analyses find that Republicans engaged in extreme partisan gerrymandering in seven states. Partisan gerrymandering is accomplished by packing as many supporters of the opposition party as possible into as few districts as possible. The opponents will win these seats overwhelmingly. Meanwhile, supporters of the favored party are spread more evenly across the other districts, so this party will comfortably win as many seats as possible. Partisan gerrymandering has also dramatically affected thousands of seats in state legislatures.

The best estimates are that, through gerrymandering, Republicans captured between 15 and 20 more seats in the House (out of 435) than would have been expected otherwise. After the 2022 elections, the Republicans controlled the House by a margin of just five votes (which has now shrunk to one vote due to resignations and a removal). For example, in South Carolina and Wisconsin the Republicans’ percentage of each state’s House seats is about 26-percentage points higher than the percentage of their vote in statewide races. (In SC: Republicans got roughly 60% of the vote in the Governor’s and Senator’s races but, due to gerrymandering, won 6 out of 7 House seats, 86%. In WI: Republicans got roughly 49% of the vote in the Governor’s and Senator’s races but, due to gerrymandering, won 6 out of 8 House seats, 75%.)

Extreme partisan gerrymandering means that officials get elected by a small handful of their constituents – those who vote for them in the primary election (where turnout is typically very low). Given that the party that will win the general election is in most cases pre-determined by gerrymandering or a district’s natural political characteristic, the winning candidate is selected by the small number of voters who are motivated enough to turn out and vote in the primary election. These are typically the party’s most committed and partisan voters. The result is that elected officials are in effect picking their voters, rather than most voters having any real choice about who their elected representative will be. (See this previous post for more details on gerrymandering and its undermining of democracy.)

The Supreme Court, prior to the 2022 elections, blocked the implementation of changes to House districts in at least seven states despite lower courts’ rulings that the districts were unconstitutionally gerrymandered. After the election, it confirmed that the districts were unconstitutional. This probably delivered at least seven seats to Republicans that otherwise would have gone to Democrats. (See this previous post for more detail on the Supreme Court’s rulings and their effects on the election.) The shift of five seats from Republicans to Democrats would have changed the control of the House, which would have made a dramatic difference in policy making in the House and for the country. It’s hard to believe that the Supreme Court’s actions and timing were anything but blatantly political.

Racial and partisan gerrymandering are closely linked because a large percentage of Blacks typically vote for Democrats. Racial gerrymandering is still very much present in the south. For example, in Alabama, there are seven congressional districts. Twenty-seven percent of the population is Black (and four percent is in other non-white categories), but by packing as many Black voters into one district as possible and splitting up the other Black voters among the other districts, there is only one Black-majority district in the state. The courts have ordered the creation of another Black-majority district but Alabama officials have been resistant. From a partisan perspective, Alabama Republicans got 67% of the vote in the Governor’s and U.S. Senator’s race but, because of gerrymandering, won 86% of the House seats (6 of 7), a 19-percentage point difference.

Similarly, in Louisiana, there are six congressional districts. A third of the population is Black, but, again, by packing as many Black voters into one district as possible and splitting up the other Black voters among the other districts, there is only one Black-majority district in the state. From a partisan perspective, Louisiana Republicans got 62% of the vote in the U.S. Senator’s race but, because of gerrymandering, have 83% of the House seats (5 of 6), a 21-percentage point difference.

My next post will present ways to reduce partisan and racial gerrymandering, which would make our elections for the U.S. House (and state legislatures) more democratic, i.e., more representative of a state’s and district’s population.

[1] Dayen, D., 1/29/24, “America is not a democracy,” The American Prospect (https://prospect.org/politics/2024-01-29-america-is-not-democracy/)

[2] Leaverton, C., 1/20/23, “Three takeaways on redistricting and competition in the 2022 midterms,” Brennan Center for Justice (https://www.brennancenter.org/our-work/analysis-opinion/three-takeaways-redistricting-and-competition-2022-midterms)